The cleantech industry is poised for growth, but the upcoming US election will have implications for its future.

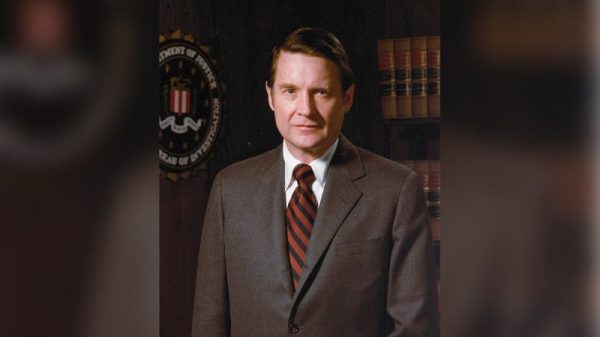

The two candidates, former US President Donald Trump and current Vice President Kamala Harris, hold divergent views on climate change, the importance of clean energy and the impact the sector has on the economy.

What do Harris and Trump think about climate change?

As vice president, Harris has supported President Joe Biden’s various climate initiatives.

The Inflation Reduction Act (IRA), enacted by Biden in 2022, is regarded as the largest climate investment in US history, and Harris cast the tie-breaking vote for it to pass. It has helped launch over 330 new climate projects.

King Lip, chief strategist at Baker Avenue Wealth Management, told Reuters in August that he expects Harris to continue supporting the clean energy initiatives outlined in the Democratic Party platform if she wins.

According to the platform, a Democratic administration will “continue to invest in clean energy research and development,” with plans to establish a laboratory for climate research and an Advanced Research Projects Agency for Climate, while also continuing to eliminate carbon from the transportation sector.

The Republican Party platform promises “reliable and abundant low-cost energy” and outlines measures it will take to support the oil and gas industry. Trump has a history of denying climate change — in August 2020, the Brookings Institution published an article that counted 74 actions his administration took to weaken environmental protections.

More recently, Washington Post sources alleged that, during a May dinner with the country’s wealthiest oil executives, Trump promised to reverse several of Biden’s environmental policies in exchange for campaign donations. An investigation was subsequently launched by the Committee on Oversight and Accountability.

Harris vs. Trump: Cleantech funding and tax policies

Federal funding to support research and development (R&D) will play a pivotal role in shaping the future of US cleantech innovation, and tax policies may influence venture capital (VC) investments.

Here’s what Harris and Trump have said about cleantech funding and tax policies.

Harris and the Democrats

Democrats remain committed to preserving and advancing Biden’s climate and clean energy agenda, and will continue encouraging investment in the sector while dedicating federal resources to climate R&D. By providing tax incentives and rebates, the administration aims to make sustainable infrastructure and energy-efficient technologies more affordable.

Democrats will also expand workforce training initiatives through the American Climate Corps to ready the workforce for well-paying union jobs in the clean energy sector. Furthermore, promoting competition between big oil and clean alternatives will contribute to achieving climate goals and advancing the clean energy transition.

VCs have been quick to support Harris. Among them is Chris Sacca of Lowercarbon Capital, a firm that backs companies developing technologies to reduce carbon emissions. However, increasing the corporate tax rate to 28 percent from 21 percent could have implications for VC investments. Higher taxes would lower the expected returns for both VC firms and entrepreneurs, potentially leading to reduced investments or engagement with startups.

Trump and the Republicans

Trump has pledged to end inflation and stimulate the economy by streamlining government spending and boosting domestic energy production, with a focus on traditional sources like oil and fossil fuels.

He has also discussed his intention to permanently cut the corporate tax rate to 21 percent.

To achieve their economic vision, the Republicans aim to eliminate the “socialist” Green New Deal, a set of policy proposals introduced in 2021 by Representative Cori Bush (D-MO). It was reintroduced in 2023 by Senator Edward J. Markey (D-Mass.) and Congresswoman Alexandria Ocasio-Cortez (D-NY-14). While the Green New Deal hasn’t been fully implemented, its policies influenced the IRA, which includes investments in clean energy and climate initiatives.

Project 2025, a presidential transition operation developed by the Heritage Foundation, a conservative think tank, includes a roadmap that calls for a repeal of the IRA, as well as major budget cuts to departments that oversee renewable energy projects. Trump has denied any involvement with Project 2025, but many of the manifesto’s authors worked for the former president during his last term. Trump also called for a 3 percent reduction in funding to the Department of Energy’s Office of Energy Efficiency and Renewable Energy in his 2019 budget request.

However, the Republican emphasis on corporate tax cuts could have positive implications for cleantech startups. A study conducted in October 2023 by economists associated with the National Bureau of Economic Research and the Treasury Department found that the Tax Cuts and Jobs Act (TCJA), which Trump signed into law in 2017, boosted corporate investments by about 20 percent over two years.

While a significant portion of the increased cash flow from the TCJA was directed toward share buybacks and dividends, it’s worth noting that a portion of the funds was also reinvested in R&D.

Harris vs. Trump: Renewable energy, nuclear power and CCS

The US is experiencing a surge in renewable energy adoption, particularly wind and solar power.

The country is behind only China when it comes to installed wind capacity, and July data from the US Energy Information Administration shows that for the first time ever, wind and solar produced more energy year-to-date than coal.

There is also expanding interest in nuclear power generation.

According to a recent Axios report, the first seven months of 2024 saw a surge in investment in advanced nuclear technology, reaching US$3.9 billion compared to the US$355 million invested in all of 2023.

Here’s what Harris and Trump have said about renewable energy, nuclear power and more.

Harris and the Democrats

A Harris administration would likely present a more formidable challenge to big oil interests compared to Trump. The former prosecutor has a history of promoting industry reform. As attorney general of California, Harris defended AB32, a state law requiring a reduction of greenhouse gas emissions, from the Rocky Mountain Farmers Union, which argued that the law conflicted with the Clean Air Act and created an illegal barrier to interstate commerce in 2012.

In addition, the Democrat platform promises to raise taxes and close loopholes for big oil companies and save families money at the pump, all while driving growth in the renewable energy sector.

While the Democratic Party has historically had mixed views on nuclear energy, attitudes have shifted in recent years as members recognize that power demand is heavily increasing.

Biden’s policies have unlocked funding for nuclear power, expanding tax credits to include nuclear power projects.

Trump and the Republicans

The Republican Party platform calls to end restrictions on oil and natural gas in a bid to lower energy costs, and Trump has been vocal about his intention to continue using fossil fuels. He has also said that the US would exit the Paris Agreement again if he is re-elected, and has proposed federal spending cuts that could affect funding for Department of Energy and Environmental Protection Agency programs that support renewable energy initiatives.

It’s possible that Trump’s plans will face pushback from energy companies that have made investments in clean energy projects. In particular, carbon capture and storage (CCS) technology has generated jobs in Republican states, and they could be at risk if the IRA is rolled back by Trump and his administration.

“I think that reality is making this particular carbon management piece of legislation — not untouchable, but I think very stable,” CarbonCapture CEO Adrian Corless told Politico in June. Even Mike Sommers, president of the American Petroleum Institute, has voiced his support for the parts of the IRA that are good for business.

While his stance on clean energy has been largely skeptical, Trump does show support for one type in particular: nuclear power. ‘We have to produce massive electricity,’ he said, referencing the power demands of artificial intelligence during an interview with Shawn Ryan, a former Navy SEAL and host of “The Shawn Ryan Show.’

“If I’m president,” he continued, “we’ll do it through natural gas and nuclear.’

In terms of legislation, in July, the House Appropriations Committee passed House Bill 8997, legislation that would funnel US$9 billion into two nuclear reactor demonstration projects and fund the deployment of one small modular reactor.

The bill was developed by Energy-Water Appropriations Subcommittee Chair Chuck Fleischmann, who has endorsed and aligned himself with Trump on multiple occasions.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.