Ukraine has been hit by a surge in Russian ballistic missile attacks, about a third of which used North Korean weapons that can only fly because they run on Western circuitry, obtained despite sanctions, according to Ukrainian military officials.

August and September saw a spike in ballistic missile attacks, when Ukraine first publicly detailed the use of the KN-23.

These less-sophisticated missiles are part of North Korea’s growing support to Moscow, which also includes about 11,000 North Korean soldiers deployed to Russia’s Kursk region.

Crucial components used in the North Korean missiles are produced by nine Western manufacturers, including companies based in the United States, the Netherlands and the United Kingdom, according to a recent report by Ukraine’s Independent Anti-Corruption Commission (NAKO), a civil society organization. Some parts of the KN-23/24 missiles they analyzed were produced as recently as 2023, suggesting a swift delivery pipeline to North Korea.

The warehouse was full of damaged drones and burned missile parts. In different buildings, hundreds of microchips were carefully separated into folders named for various weapons used by Russia – “Shahed,” “Iskander,” and “KN-23.”

“Everything that works to guide the missile, to make it fly, is all foreign components. All the electronics are foreign. There is nothing Korean in it,” said Andriy Kulchytskyi, head of the Military Research Laboratory of Kyiv’s Scientific Research Institute of Forensic Expertise.

“The only thing Korean is the metal, which quickly rusts and corrodes,” he added.

A Ukrainian Defense Intelligence official, who spoke on the condition of anonymity, said their investigations are hampered by the damage to the missile fragments, but it’s still possible to determine that “the vast majority of components are Western components. Probably 70% are American, from well-known companies […] They also use components made in Germany and Switzerland.”

A report released earlier this year by the UK-based investigative organization Conflict Armament Research, or CAR, found that 75% of components in one of the first North Korean missiles used to attack Ukraine were from US-based companies.

Sanctioned goods move though China

There is no reliable information on how exactly the components make their way into North Korea, according to weapons-tracing experts. But all signs to point to China as the likely conduit, experts say.

“We have successfully traced some of those components, and the last known custodians are Chinese companies,” said Damien Spleeters, deputy director of operations at CAR, which works to independently document diverted weapons. That means Chinese firms bought the components from manufacturers and a series of intermediaries.

CAR has a policy of not “naming and shaming” specific manufacturers because there is no evidence the firms deliberately shipped the parts to North Korea.

“Some parts of these components may be actually fake and made in China,” said Victoria Vyshnivska, a senior researcher at NAKO. “But we cannot be 100% sure,” she added, as the companies in question often failed to respond to questions.

One manufacturer was able to provide NAKO with evidence that a low-value electronic component found in a North Korean missile was counterfeit.

CAR and others consider that middleman distribution companies – not manufacturers – are the primary issue.

There are more than 250 companies whose components have been identified in North Korean missiles, according to CAR. But the majority of those electronics are sold to five main distributors, which are all based in the United States and Canada. CAR is urging policymakers to focus more effort on regulating those distribution companies.

The US Commerce Department has already stepped up its targeting of entities and shell companies that have shipped sanctioned goods to Russia and Belarus.

Ukrainian officials argue the poor enforcement of the sanctions regime by Western nations is one major issue.

Vladyslav Vlasiuk, the Ukrainian president’s commissioner for sanctions policy, said he was hopeful the incoming Trump administration would seek greater control over the illicit trade.

That echoes the sentiment of the US Senate Permanent Subcommittee on Investigations, which earlier this year slammed US manufacturers for not doing enough to vet potential buyers, despite having adequate “resources, funding, and knowledge.”

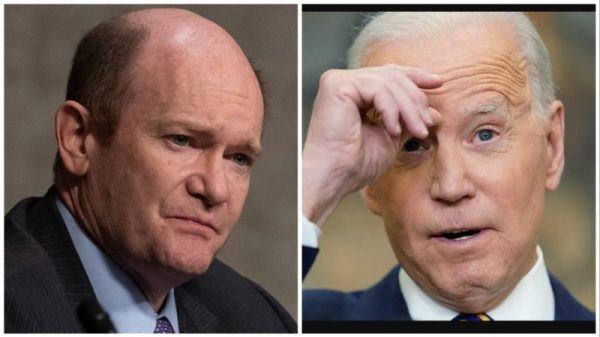

“Our findings reveal a distinct disinterest in evaluating and improving corporate compliance practices and particularly, monitoring those distributors, the middlemen,” said Senator Richard Blumenthal (D-CT) in September.

Components also continue to be diverted to Iran and to Russia directly, according to the Ukrainian intelligence official.