The outlook for rare earths is supported by strong supply and demand fundamentals as the world heads into a new economic era with a focus on clean energy and technological advancements.

But with supply chain worries rising, it’s worth looking at which countries have the highest rare earths reserves. Many of the world’s major rare earths producers have large reserves, but some countries have low rare earths output and high reserves.

Case in point — mines in Brazil produced only 80 metric tons (MT) of rare earth elements in 2023, but the nation’s reserves are tied for third highest in the world. It’s possible that countries like this could become bigger players in the space in the future.

One caveat is that reserves information is unavailable for a few rare earths producers, including Myanmar which took the third spot for rare earths production last year.

Here’s an overview of rare earths reserves by country, with a focus on the eight countries whose reserves are over 1 million MT. Data is taken from the US Geological Survey’s latest report on rare earths.

1. China

Reserves: 44 million MT

Unsurprisingly, China has the highest reserves of rare earth minerals at 44 million MT. The country was also the world’s leading rare earths producer in 2023 by a long shot, putting out 240,000 MT.

Despite its top position, China remains focused on ensuring that its rare earths reserves remain elevated. Back in 2012, the Asian nation declared that its reserves of these materials were declining; it then announced in 2016 that it would raise domestic reserves by establishing both commercial and national stockpiles.

The country has also been reigning in illicit rare earths mining for a number of years now, taking steps such as shutting illegal or environmentally non-compliant rare earths mines and limiting production and exports. The production limits have been easing though, and last year the country raised mining quotas by more than 8 percent over 2022 in its sixth consecutive increase.

China’s dominance in both rare earth elements production and reserves has caused problems in the past. Rare earths prices surged when the country cut exports in 2010, resulting in an ongoing rush to secure supply of the minerals elsewhere.

In recent years, China has begun importing more heavy rare earths from Myanmar, for which the US Geological Survey does not have rare earths reserves data. While China has stricter environmental regulations, the same cannot be said for Myanmar, and the mountains along its border with China have been heavily damaged by rare earths mining.

Rare earths prices soared to their highest level in 20 months, according to OilPrice.com, in early Q3 2023 coinciding with a temporary production halt in Myanmar, which accounted for 38 percent of China’s rare earth materials imports in the first seven months of 2023.

2. Vietnam

Reserves: 22 million MT

Vietnam’s rare earths reserves stand at 22 million MT. It reportedly hosts several deposits with concentrations against its northwestern border with China and along its eastern coastline. The majority of rare earths in the country can be found in primary ore deposits, with a smaller amount located in coastal placer deposits. While this potential was previously untapped, that has now changed as the country looks to become an alternative to China.

Vietnam’s rare earths production was minuscule in 2022 at 1,200 MT, but it was even less in 2023 at 600 MT. Vietnam is the only country outside of China to have a vertically integrated rare earths magnet supply chain, according to Reuters, and it has attracted interest from companies in a variety of sectors. The country’s goal is to produce 2.02 million MT of rare earths by 2030.

However, the arrests of six rare earths executives, including the chairman of Vietnam Rare Earth JSC (VTRE), in October 2023 may put a kink in those plans. ‘VTRE’s chairman, Luu Anh Tuan, was accused of forging value-added-tax receipts in trading rare earths,’ reported Asia Financial.

3. Brazil

Reserves: 21 million MT

Although Brazil has the third largest rare earths reserves globally, the latin nation was not a major producer of rare earths in 2023, with production flat at a tiny 80 MT on par with the previous year and even lower than its 2021 total of 500 MT.

However, that will soon be changing as rare earths company Serra Verde began commercial production from its Pela Ema rare earths deposit at the top of 2024. Pela Ema is an ionic clay deposit that will produce the four critical magnet rare earth elements: neodymium, praseodymium, terbium and dysprosium. According to the company, it is the only rare earths operation outside of China to produce all four of those magnet rare earths.

4. Russia

Reserves: 10 million MT

Russia produced 2,600 MT of rare earths in 2023, more than Brazil and Vietnam. The Russian government shared plans in 2020 to invest US$1.5 billion in order to compete with China in the rare earths market.

Russia’s invasion of Ukraine caused some concern over possible disruptions to the rare earths supply chain in the US and Europe, and there are signs the government has had to put its domestic rare earths sector development plans on ice while it’s mired in war.

5. India

Reserves: 6.9 million MT

India’s rare earths reserves sit at 6.9 million MT, and it produced 2,900 MT of rare earths in 2023 on par with the previous year. India has nearly 35 percent of the world’s beach and sand mineral deposits, which are significant sources of rare earths. The country’s Department of Atomic Energy released a statement in December 2022 breaking down the country’s production and refining.

More recently, the Government of India is reportedly putting policies and legislation in place to establish and support rare earths research and development projects to take advantage of its reserve base.

6. Australia

Reserves: 5.7 million MT

While Australia was the fourth largest rare earths-mining country in 2023 at 18,000 MT of production, it has the sixth largest reserves in the world. Currently, its reserves stand at 5.7 million MT.

Rare earths have only been mined in Australia since 2007, but extraction is expected to increase moving forward. Lynas Rare Earths (ASX:LYC,OTC Pink:LYSCF) operates the Mount Weld mine and concentration plant in the country; it also runs a rare earths refining and processing facility in Malaysia. The company is considered the world’s largest non-Chinese rare earths supplier.

Hastings Technology Metals’ (ASX:HAS,OTC Pink:HSRMF) Yangibana rare earths mine is shovel ready and the company recently signed an off-take agreement with Baotou Sky Rock for concentrates produced at the mine. Hastings expects the operations to produce up to 37,000 MT of rare earths concentrate annually and deliver first concentrate in Q2 2025.

7. United States

Reserves: 1.8 million MT

While the US reported the second highest output of rare earths in 2023 at 43,000 MT, the country takes the seventh top spot in terms of global rare earths reserves.

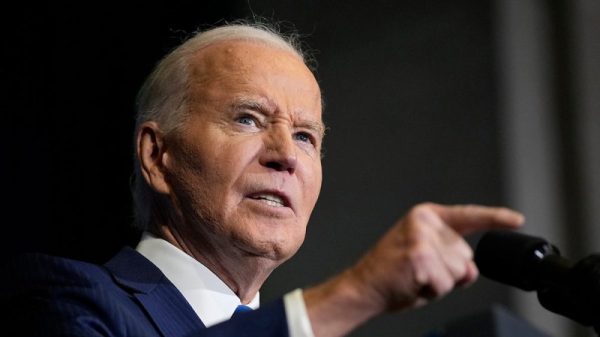

Rare earths mining in the US now happens only at California’s Mountain Pass mine. Over the past few years, the Biden Administration has made several moves toward strengthening the nation’s rare earths industry.

In February 2021, President Joe Biden signed an executive order aimed at reviewing shortcomings in America’s domestic supply chains for rare earths, medical devices, computer chips and other critical resources. The next month, the US Department of Energy announced a US$30 million initiative to research and secure domestic supply chains for rare earths and battery metals such as cobalt and lithium. The government released a follow-up fact sheet about the progress made in these initiatives in February 2022. The US Department of Energy announced a US$32 million investment in new rare earths production facilities in July 2023.

8. Greenland

Reserves: 1.5 million MT

Although Greenland’s rare earths reserves number is close to that of the US, the island nation currently doesn’t produce the metals. However, it does have two significant rare earths projects with large reserves, private company Tanbreez Mining’s Tanbreez project and Energy Transition Minerals’ (ASX:ETM,OTC Pink:GDLNF) Kvanefjeld project. The USGS only measures proven economic reserves, but in terms of total reserves for rare earths projects globally, they placed first and third respectively with 28.2 and 10.2 million metric tons of total rare earth oxides.

After signing an exploitation license with the government in 2020, Tanbreez is currently working on securing financing for its project’s development; avenues being explored include discussions with independent oil and gas executives and the creation of critical metals NFTs backed by the project. The company has its sights set on 2024 for production.

While Energy Transition Minerals had previously signed a license for Kvanefjeld, it was revoked by Greenland’s current government due to the company’s plans to exploit uranium. The company submitted an amended plan that did not include uranium, but the updated version was rejected as well in September 2023.

FAQs for rare earths reserves

What are rare earth metals?

Rare earths are a basket of 17 naturally occurring elements comprised of 15 elements in the lanthanide series, plus yttrium and scandium. Other than scandium, all rare earths can be divided into “heavy” and “light” categories based on their atomic weight. Heavy rare earths are generally more sought after, but light rare earth elements can of course be important too.

Is lithium a rare earth metal?

Lithium is not a rare earth metal. It is an alkali metal in the same group as sodium, potassium, rubidium and cesium.

What is the global total for rare earths reserves?

Global rare earths reserves amount to 130 million MT. With demand for rare earth minerals ramping up as hype about electric vehicles and other high-tech products continues, it will be interesting to see how the top producers contribute to future supply.

What is the annual production of rare earths?

According to the US Geological Survey, global rare earths production in 2023 came in at 350,000 MT, up from 300,000 MT the previous year. The production of rare earths has ramped up aggressively in recent years — only a decade ago, global production was just above 100,000 MT, and it first broke 200,000 MT in 2019.

Who is the largest producer of rare earth metals in the world?

China has consistently been the largest producer of rare earths, and its 2023 production made up 240,000 MT of the world’s 350,000 MT. In terms of specific rare earths mines, the top producer is the Bayan Obo mine in Inner Mongolia, an autonomous region in Northern China. The mine is owned by the state-owned Baotou Iron and Steel Group.

Are there rare earth minerals in Europe?

There are currently no rare earths mines in Europe, but there are multiple countries with reserves, including one with a significant new discovery. In early 2023, Swedish state-owned company LKAB announced it had identified the continent’s largest rare earths deposit, the Per Geijer deposit, with rare earths resources of over 1 million MT of oxides.

With the European Union focusing heavily on building its own supply chain with the European Critical Raw Materials Act, the Per Geijer deposit could develop into an important source of rare earths for the region.

Several other countries in Europe hold significant rare earths reserves as well. Greenland hosts many deposits totaling 1.5 million MT of rare earths reserves along its coastline, with the majority located in the southwest of the country. The Gardar igneous province in the south hosts the largest ones.

Countries in the Fennoscandian Shield — such as Norway, Finland and, of course, Sweden — also host rare earth deposits, as the region has similar mineralization to Greenland.

What are the most technologically useful rare earth metals?

Rare earth metals play a significant role in various technologies. They are often used in electronics such as laptops and smartphones. Rare earth oxides such as neodymium and praseodymium are used in magnets, aircraft engines and green technologies, including wind turbines and electric vehicles. Samarium and dysprosium are also used in rare earth magnets. Phosphor rare earths such as europium, terbium and yttrium are used in lighting, as are cerium, lanthanum and gadolinium.

How are rare earths mined?

Rare earth elements are either mined from open pits, like many other metals and minerals, or they are mined through in-situ leaching. The metals are found in hard-rock deposits, ionic clay deposits and mineral sands. Some minerals that are mined for rare earths are bastnäsite, monazite, loparite and xenotime.

The open-pit mining process for rare earths is similar to that of other minerals: hard rock is mined, ore is separated from tailings and then it is refined. In in-situ leaching, which is also a common method of mining uranium, miners pump a chemical solution into an orebody. The solution dissolves the targeted materials into a brine that is then pumped back out of the ore and into collection pools. Rare earths mining also has a final step, which is the separation of the different rare earths from each other.

Why is it difficult to mine rare earth metals?

Although rare earths aren’t as rare as you might assume from the name, finding economic deposits is very difficult. This is even more so the case for the heavy rare earths, as orebodies containing them are less abundant versus light rare earths.

Another road bump for rare earths is the separation process. Because the rare earth elements all have similar chemical behavior to each other, they are very tough to separate, making the process difficult and expensive. The most common separation method is solvent extraction, but it is lengthy and can take hundreds to thousands of cycles to achieve high purity levels, according to the Science History Institute.

Lastly, the environmental risks associated with rare earths mining mean even more care needs to be taken to minimize damage to the environment and to the people near the mine.

Is rare earths mining bad for the environment?

Rare earths mining can be very damaging to local environments, especially when it comes to illegal and unregulated mines. A major issue with mining rare earths is that the ore they are extracted from also often contains thorium and uranium, which are both radioactive. This means the separation of rare earths from this ore must be handled carefully, as the waste produced will be radioactive as well.

Unfortunately, it is common for this radioactive waste to make its way into groundwater and streams, which is incredibly damaging to the environment and to nearby communities that rely on this water. This can be seen in the mountains of Southern China and Northern Myanmar, both of which have been heavily exploited for their rare earths.

A report from Global Witness that investigates the effects of rare earths mining in these regions shows that mining in Myanmar has escalated in recent years after China began closing its own mines and outsourcing to the neighboring country. As of mid-2022, 2,700 illegal collection pools from in-situ leaching in the mountains had been identified, and they covered an area the size of Singapore. Those who lived in the region reported difficulty accessing safe drinking water and said local wildlife and fish were dying out.

Additionally, the in-situ leaching process can damage the rocks that are being extracted. Global Witness found that over 100 landslides have already taken place in China’s Ganzhou region as a result of this extraction, and the damage to Myanmar’s mountains is substantial as well.

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.