At the start of the year, experts predicted nickel supply to maintain a surplus and the price would stay rangebound through 2024. It opened the first quarter priced at US$16,600 per metric ton (MT) on January 2.

The price was stable during January and February, but March brought with it some volatility with strong gains pushing it to a quarterly high of US$18,165 per MT on March 13.

However, the rising price failed to hold and nickel once again dropped below the US$17,000 mark by the end of the month. Ultimately, the metal fell to US$16,565 on March 28, resulting in a slight loss for the quarter.

Oversupply from Indonesia

Lackluster pricing in the nickel markets is largely the result of the metal’s ongoing oversupply position. The largest factor is the continued elevated production rates from Indonesia, which maintains its position as the global leader for the metal. The country produced 1.8 million MT of nickel in 2023, according to the USGS’s latest Mineral Commodity Summary, representing half of global supply.

The country’s production has climbed exponentially over the past decade, and this was exacerbated by government initiatives that placed strict limits on the export of raw materials to encourage investment in production and refinement.

Data from S&P Global Market Intelligence provided by Mazumdar showed results of the mandates saw an estimated US$20 billion flowing into the industry in early 2023, with another US$10 billion in undisclosed funding, much of it originating from China.

Despite the lower quality of material coming from Indonesia, the investment was made to shore up supply lines for Chinese battery makers and earmarked for electric vehicle production. However, EV demand has waned through 2023 and into 2024 due to the high-interest rates, range anxiety and charging capacity, increasing nickel stockpiles and contributing to an ongoing oversupply situation.

A report on the nickel market provided by Jason Sappor, senior analyst with the metals and mining research team at S&P Global Commodity Insight, showed that short positions began to accumulate through February and early March on speculation that Indonesian producers were cutting operating rates due to a lack of raw material from mines, which helped push the price up.

The lack of material was caused by delays from a new government approvals process for mining output quotas Indonesia implemented in September 2023. The new system will allow mining companies to apply for approvals every three years instead of every year. The implementation has been slow, which was exacerbated by further delays while the country went through general elections.

The nickel market found additional support on speculation the United States government was eyeing sanctions on nickel supply out of Russia. However, base metals were ultimately not included in the late February sanctions. The price began to decline through the end of March as Indonesian quota approvals accelerated.

Production cuts from western producers

According to data from Macquarie Capital provided by Mazumdar, nickel prices slumping below the US$18,000 mark has made approximately 35 percent of production unprofitable, which would jump to 75 percent if the price were to fall below US$15,000.

Mazumdar indicated the pricing challenges have led to cuts from Australian producers like First Quantum (TSX:FM,OTC Pink:FQVLF) and Wyloo Metals which both announced the suspension of their respective Ravensthorpe and Kambalda nickel mining operations. Additionally, major Australian nickel producer BHP (ASX:BHP,NYSE:BHP,LSE:BHP) is considering cuts of its own.

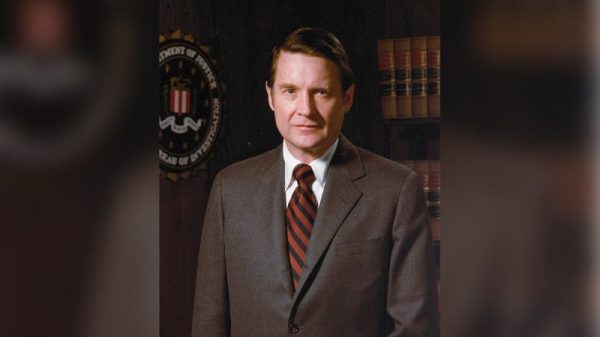

Nickel price, Q1 2024.

Chart via the London Metal Exchange.

French territory New Caledonia’s nickel mining industry is facing severe difficulties due to faltering prices. The French government has been in talks with Glencore (LSE:GLEN,OTC Pink:GLCNF), Eramet (EPA:ERA) and raw material trader Trafigura, who have significant stakes in nickel producers in the country, and has offered a 200 million euro bailout package for the nation. The French government set a March 28 deadline for New Caledonia to agree to its rescue package, but a decision has not yet been reached as of April 11.

Earlier this year, Glencore announced plans to shutter and search for a buyer for its Koniambo operations, which it said has yet to turn a profit and is unsustainable even with government assistance. For its part, Trafigura has declined to contribute bail-out capital for its 19 percent stake in Prony Resources Nouvelle-Caledonie and its Goro mine, which is forcing Prony to find a new investor before it will be able to secure government funding. On April 10, Eramet (EPA:ERA) reached its own deal with France for its subsidiary SLN’s nickel operations that would see the company extending financial guarantees to SLN.

The situation has exacerbated tensions over independence from France, with opponents of the agreement arguing it risks the New Caledonia’s sovereignty and that the mining companies aren’t contributing enough to bailouts of the mines, which employ thousands of New Caledonians. Reports on April 10 indicated that protests have turned violent.

While cuts from Australian and New Caledonian miners aren’t expected to shift the market from a surplus, Mazumdar expects it will help to maintain some price stability in the market.

“The most recent forecast projects demand (7 percent CAGR) will grow at a slower pace than demand (8 percent CAGR) over the next several years, which should generate more market surpluses,” he said.

Government intervention

“The recent supply curtailments also limit the supply alternatives to the dominance of Indonesia, where the majority of production is backed by Chinese investment. This comes at a time when the US and the EU are looking to reduce their dependence on third countries to access critical raw materials, including nickel,” Manthey said.

This was affirmed by Mazumdar, who said the US is working to combat the situation through a series of subsidies designed to encourage western producers and aid in the development of new critical minerals projects.

“The US Inflation Reduction Act (IRA) promotes via subsidies sourcing of critical minerals and EV parts from countries with which it has a free trade agreement or a bilateral agreement. Indonesia and China do not have free trade agreements with the US,” Mazumdar said.

He went on to suggest that the biggest benefactors of this plan would be Australia and Canada, but also noted that with prices remaining depressed multi-billion dollar projects would face headwinds to get off the ground.

Green nickel

One way to encourage western production has been creating a separate price scheme with the creation of a green nickel market that plays into western producers’ focus on environmental, social and governance (ESG). Green nickel is defined as a low-carbon product that produces less than 20 MT of carbon dioxide per MT of production.

The oversupply of lower-grade laterite has pulled prices down across the board, including for higher-grade and more environmentally friendly sulfide projects like those in Australia and Canada. This has led to the suggestion of premium pricing for green nickel; however, this hasn’t gained much traction on the London Metals Exchange (LME).

“There is little evidence that a premium for ‘green nickel’ producers or developers has much momentum although an operation with low carbon emissions may have a better chance of getting funding from institutional investors in western countries,” Mazumdar said.

Even though there might not be much interest in green nickel on the LME, there have been some vocal proponents like Wyloo’s CEO Luca Giacovazzi. He sees the premium as being essential for the industry, adding the industry should be looking for a new marketplace if the LME is unwilling to pursue a separate listing for green nickel.

The calls for a premium have largely come from western producers that incur higher labor and production costs to meet ESG initiatives, which is happening less amongst their counterparts in China, Indonesia and Russia.

Western producers were caught off guard early in March as PT CNGR Ding Xing New Energy, a joint venture between China’s CNGR Advanced Material (SHA:300919) and Indonesia’s Rigqueza International PTE, applied to be listed as a “good delivery brand” on the LME. The designation would allow the company, which produces Class 1 nickel, to be recognized as meeting responsible sourcing guidelines set by the LME.

If it is approved, which is considered to be likely, this would be the first time an Indonesian company would be represented on the LME. However, there has been pushback from western miners who have noted that production in Indonesia faces a range of ESG and responsible resourcing challenges.

Investor takeaway

Nickel is a critical metal for the production of batteries to be used in EVs. Generally, battery-grade nickel is processed from the higher quality raw material produced from sulfides, but more recently Chinese production has turned to lower quality laterites. While batteries made from laterite nickel have lower energy density, their cost is also much lower, which may provide key cost savings for EV buyers.

However, with lingering inflation and high interest rates globally, demand for EVs has fallen off over the past two years, which has in turn reduced the demand for nickel.

Meanwhile, despite some slow down due to the approval process, high supply rates from Indonesia have continued into 2024 and there doesn’t seem to be cuts on the horizon from the nation.

These factors have led to a drop in profits and curtailments from large nickel operations in western nations, and made companies unlikely to pursue the construction of new projects in the near term.

“Looking ahead, we believe nickel prices are likely to remain under pressure, at least in the near term, amid a weak macro picture and a sustained market surplus,” Manthey said.

The continued surplus in the market may provide some opportunities for investors looking to get into a critical minerals play at a lower cost, but a reversal may take some time.

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.