TikTok’s fate in the U.S. has never been more in doubt after Congress approved a bill that gives its parent company two options: sell it to an approved buyer or see it banned.

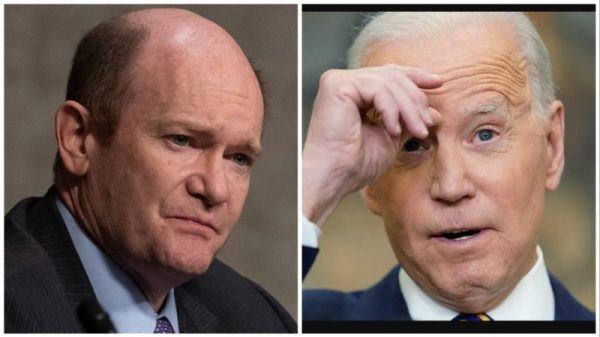

President Joe Biden signed the legislation into law on Wednesday.

But it could take years for the TikTok ban to actually go into effect, since its Chinese-owned parent company, ByteDance, is likely to challenge the statute in court.

And even if it survives a legal challenge, no one is quite sure what would happen next.

It would probably be several years from now.

According to the statute’s language, ByteDance would have nine months to divest and find an American buyer for TikTok once the bill is signed into law.

On top of that, the president can push back the deadline by an additional 90 days.

That means, without a sale, the soonest TikTok could shut down in the U.S. would be more than one year from now.

But it’s more complicated than that.

If ByteDance sues to block the implementation of the statute — which it has said it would do — the bill will be taken up by the D.C. Circuit Court of Appeals, according to Isaac Boltansky, director of policy for the financial services firm BTIG.

Boltansky said ByteDance would file a suit no later than this fall. And while the case is under judicial review, the “clock” on any ban is effectively paused, he said.

Once the D.C. court issues its ruling, whichever side loses is likely to request a review by the U.S. Supreme Court.

That would forestall the ban by another year — meaning nothing would go into effect until 2026, Boltansky said.

TikTok will argue that the ban is unconstitutional and that it’s also taken steps to protect American users’ data. The app has already launched an aggressive lobbying campaign, featuring a number of small-business owners and influencers who say it’s their lifeblood.

“We have got to make enough noise so that they don’t take away our voice,” TikTok user @dadlifejason, who has 13.8 million followers, says in a TikTok ad shared on social media.

The bill stipulates that TikTok can continue to operate in the U.S. if ByteDance sells the app to a U.S.-approved firm.

While large U.S. tech companies would love to get their hands on the platform, Boltansky said that Biden administration regulators — not to mention GOP critics of Big Tech firms — have no interest in expanding the power, reach or influence of such companies.

Some other outside groups might emerge. At least one led by Steve Mnuchin, who was Treasury secretary in the Trump administration, has already sought to make a bid, telling CNBC in March that he was putting together an investor group. The Wall Street Journal has also reported that former Activision Blizzard CEO Bobby Kotick was looking for potential buyer partners. While ByteDance, which owns other companies, is worth hundreds of billions of dollars, TikTok would fetch less than that, experts say — especially if it is sold without its powerful recommendation algorithm.

But Boltansky believes ByteDance is unlikely to agree to any kind of sale. The Chinese government has said as much, arguing that it regards the algorithm as a national security asset. And without that, TikTok becomes much less appealing to potential buyers.

It might — but the ultimate impact may be limited. The fact is, most TikTok users already have a presence on other platforms, so the impact on their livelihoods to the extent that they operate businesses on TikTok could be limited.

According to a survey from the financial services group Wedbush, approximately 60% of TikTok user respondents said they’d simply migrate to Instagram (or Facebook) in the event of a sale, while 19% said they’d go to YouTube.

Analysts with financial services company Bernstein arrived at similar estimates. In a note to clients, they forecast that Meta, which owns Instagram and Facebook, would take over as much as 60% of TikTok’s U.S. ad revenue, with YouTube gaining 25%. Snapchat would also benefit, they said.

Boltansky said many political pundits remain surprised that the bill got over the finish line. But a wave of anxiety about both Chinese influence and the impact of social media on youth converged to get it passed.

“This has been noteworthy,” Boltansky said. “Everyone is so conditioned to D.C. doing nothing or the bare minimum to keep the lights on.”

As tensions with Beijing have grown, congressional lawmakers, along with top law enforcement officials, have warned that TikTok is controlled by the Chinese Communist Party (CCP) and is a national security threat to the United States.

“It screams out with national security concerns,” FBI Director Christopher Wray testified on Capitol Hill last year

U.S. officials fear that the Chinese government is using TikTok to access data from, and spy on, its American users, spreading disinformation and conspiracy theories.

The House passed its standalone TikTok bill on a big bipartisan vote in March. But the Senate appeared in no hurry to take up the measure as Commerce Chair Maria Cantwell, D-Wash., drafted her own legislation.

That all changed when Speaker Mike Johnson, R-La., working with the White House, rolled out his $95 billion foreign aid supplemental plan last week that included billions of dollars for Ukraine, Israel and Taiwan.

Included in that sweeping aid package: the House’s TikTok bill, with some minor changes. Johnson pushed the package through his chamber, then sent the House on a recess, forcing the Senate to take it or leave it.

Rather than further delay the critical, long-stalled military and humanitarian aid, the Democratic-controlled Senate is moving to quickly pass the package — including the TikTok bill and other Johnson priorities.