A European Union study on how it should spend tens of billions of euros in high-tech investments warns that Europe may need to use the money to guard against geopolitical risks like potential U.S. decline and the rise of China or Russia.

The report by the European Commission’s Directorate-General for Research and Innovation sketches out scenarios such as a U.S. turn to isolationism, the establishment of an E.U. army, the growth of a Chinese military presence on the edges of Europe and a renewed invasion by Russia into Ukraine as potential events over the next decade that the E.U. may need to prepare for with targeted technological investment.

“This is a reflection of the high level of uncertainty we are confronted with,” Matthias Weber, the report’s lead author, said in an interview. “There aren’t safe bets anymore because there are too many uncertainties.”

The study, published last month, is intended to project what the world may look like in the year 2040 as a guide for outlays under the EU’s flagship Horizon Europe research and development program for 2025 to 2027. It was drafted by a group of academic experts and European Commission staff members who began work in January 2022 and completed the report in August, months before it was published.

Areas identified in the report as research priorities for the E.U. include artificial intelligence, climate change, “transhumanist” technologies to extend the human life span, hydrogen fuel and nanotechnologies, or the study of materials generally too small to be visible to the human eye.

The European Commission’s Directorate-General for Research and Innovation said in a statement that the report will “contribute substantially” to the E.U.’s strategic plan for Horizon Europe, as well as its longer term investment approach.

“The conclusions drawn from this study will be instrumental in the definition of a European approach to R&I [research and innovation] in the coming years,” it said.

The E.U. deliberations highlight a growing focus on security considerations in governments’ tech investments around the world during a period of renewed wars and Cold War-like rivalry. The United States and China are racing to develop next-generation technologies such as AI and advanced computer chips, calling them critical for their military supply chains. Russia is building thousands of attack drones to bolster its invasion of Ukraine; Washington has announced its own small-drone accelerator program.

“Europe’s scientific performance may need to be more tightly coupled to security,” the E.U. report says.

Weber, who directs the Center for Innovation Systems and Policy at the Austrian Institute of Technology (AIT), says the study was an attempt to help the E.U. think out-of-the-box to prepare for potential risks. Weber said his team’s mission was only to provide an analysis and that E.U. officials will make decisions on how to disburse the research funds in coming months. Horizon Europe runs from 2021 to 2027, and the majority of its 95.5 billion euro budget has already been allocated, but funding distribution for 2025 to 2027 is not yet set.

The authors raise questions over to what degree the E.U. should allow “autocratic states” — the report did not define the term, but generally it applies to countries where rulers hold absolute power and are not democratically elected — to participate in its research projects. The report argues that allowing them in is necessary to tackle some globalized challenges, versus keeping them at arms’ length for security considerations.

Weber said their study did not involve granular discussion of individual companies or countries, but reflected the increased emphasis on security and autonomy among E.U. member states generally.

The report considers a range of global scenarios that might emerge between now and 2040, including two that the authors dubbed “Mad Max” and “Home Alone.”

In the “Mad Max” scenario, the E.U. is weakened by internal political crises, the United States has withdrawn into isolationism, the Middle East is beset with new armed conflicts, and Chinese and Russian influence is growing. The authors write that issues to watch would be governments increasing defense spending, less research cooperation with the United States pushing some European countries toward China, and an increase of AI-enabled policing tools “to tackle the growing international disorder.”

The “Home Alone” scenario posits a “post-U.S.-hegemonic world order” in which the E.U. has built its own army and faces the decision of joining a military research alliance with China. In this scenario, the E.U. seeks to conduct research “with ‘trusted’ parties to strengthen its strategic autonomy and security,” even as some European nations “become more vulnerable to blackmailing efforts from authoritarian countries” due to reliance on their technological solutions.

The authors also lay out a “New Hope” scenario in which the transatlantic partnership is restrengthened “with a generally benign and globally committed U.S.”

The report’s main authors are Weber; Dana Wasserbacher, an AIT expert adviser; and Nikos Kastrinos, a European Commission policy officer, with the three drawing on input from scholars across Europe. The section with these three hypothetical scenarios lists as authors Susanne Giesecke of AIT and seven other researchers.

Weber said their study group’s broad recommendation was for the E.U. to maintain a range of technological investments to prepare for whatever future emerges.

“If there is one cross-cutting message from the entire report, I would probably say that this calls for more flexibility and adaptability,” he said.

Other governments also conduct predictive and speculative studies to help guide policymaking. The U.S. National Intelligence Council has published a “Global Trends” report every four years since 1997. The most recent one, published in 2021, forecast that the U.S.-China rivalry would set the “broad parameters” for the geopolitical environment in the coming decades, and flagged China’s intensive efforts at becoming a technological leader. It also explored varying possible outcomes of this competition, ranging from the United States securing its global leadership role to China becoming the leading state to siloed spheres of influence.

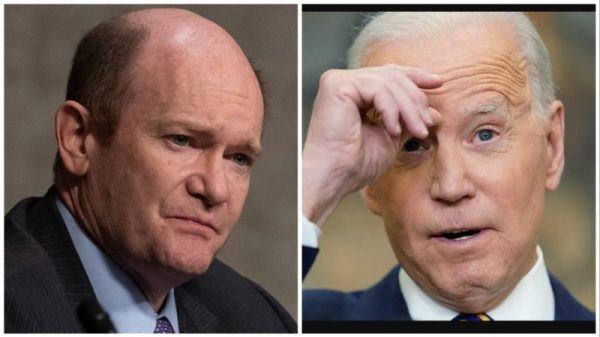

The administrations of both Biden and Donald Trump have made countering China’s technological rise a key policy focus. The Biden administration is in the process of distributing $52 billion in subsidies for U.S. semiconductor production to ensure China does not catch up.

Similarly to the U.S. report, the E.U. study predicts continued global unrest in the coming years.

“It is commonplace to say that the 21st century has been but a series of crises,” the report said. “Our exploration of disruptions indicates that the succession of crises is unlikely to stop.”